Living life as a digital nomad offers a unique blend of freedom, flexibility, and adventure. With a laptop and a reliable internet connection, you can work from a beach in Bali one month and a café in Lisbon the next. But while the lifestyle is liberating, it also comes with a distinct set of risks that traditional insurance policies often don’t cover. That’s where specialized insurance for digital nomads comes into play—providing a safety net that travels with you, no matter where you go.

One of the most critical forms of insurance for digital nomads is health coverage. Unlike employees who benefit from employer-sponsored plans, nomads must navigate a patchwork of options that vary widely by country and provider. Local health insurance may not be available or sufficient, and relying on travel insurance alone can leave significant gaps. International health insurance plans are designed to bridge this divide, offering coverage that follows you across borders and includes everything from routine checkups to emergency care. These plans often allow you to choose your healthcare providers and may even include telemedicine services, which are particularly useful when you’re in remote areas or unfamiliar healthcare systems.

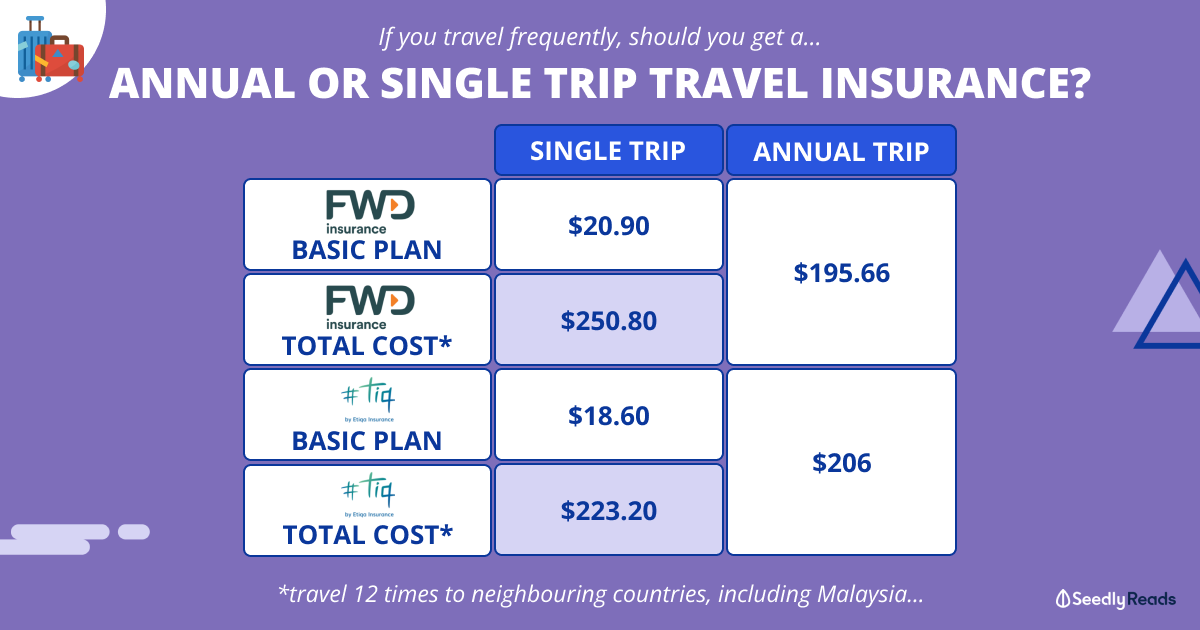

Travel insurance is another essential component of a digital nomad’s toolkit. While it’s often associated with short-term vacations, travel insurance can be tailored for long-term stays and frequent relocations. It typically covers trip cancellations, lost luggage, and emergency evacuations—scenarios that can derail your plans and drain your finances if you’re not prepared. For example, if a political crisis forces you to leave a country on short notice, or if a natural disaster disrupts your accommodation, travel insurance can help cover the unexpected costs. Some policies also include coverage for stolen electronics, which is especially important when your livelihood depends on your gear.

Liability insurance is often overlooked but can be just as important. As a freelancer or remote worker, you may be providing services that carry legal risks. If a client claims that your work caused them financial harm, professional liability insurance can help cover legal fees and settlements. This type of coverage is particularly relevant for consultants, designers, writers, and developers—anyone whose output could be subject to scrutiny or dispute. Having liability insurance not only protects your finances but also enhances your credibility with clients who may require proof of coverage before signing a contract.

Personal property insurance is another consideration, especially when you’re constantly on the move. Standard homeowners or renters insurance may not cover belongings that travel with you internationally. A dedicated policy for portable electronics and other valuable items ensures that your tools of the trade are protected against theft, loss, or damage. This is particularly important when working in shared spaces, hostels, or unfamiliar environments where security can be unpredictable. Some insurers offer worldwide coverage with low deductibles and quick claims processing, which can be a lifesaver when your laptop is stolen days before a major deadline.

Mental health support is an often underappreciated aspect of insurance for digital nomads. The lifestyle, while exciting, can also be isolating and stressful. Being far from family, navigating different cultures, and managing work-life balance without a fixed routine can take a toll. Some international health insurance plans include mental health services, such as counseling and therapy, either in person or via virtual platforms. Access to these resources can make a significant difference in maintaining emotional well-being and sustaining a healthy, productive lifestyle on the road.

Another layer of protection to consider is income protection or disability insurance. If you become ill or injured and are unable to work, this type of insurance can provide a portion of your income to help you stay afloat. For digital nomads who don’t have access to government disability benefits or employer-sponsored safety nets, this coverage can be a crucial part of financial planning. It ensures that a temporary setback doesn’t spiral into a long-term crisis, allowing you to focus on recovery without the added pressure of lost income.

Navigating the insurance landscape as a digital nomad requires careful research and a clear understanding of your needs. Policies vary widely in terms of coverage, exclusions, and geographic limitations. Some insurers specialize in serving the nomad community and offer flexible plans that can be customized based on your travel patterns, work type, and risk tolerance. It’s important to read the fine print, ask questions, and compare options before committing. A policy that works well for someone based in Europe might not be suitable for someone spending most of their time in Southeast Asia or South America.

Ultimately, insurance for digital nomads is about more than just mitigating risk—it’s about enabling freedom. When you know that your health, belongings, and livelihood are protected, you can embrace the nomadic lifestyle with greater confidence and peace of mind. You can take on new projects, explore unfamiliar places, and build a life that reflects your values and ambitions, all without the constant worry of what might go wrong. In a world where uncertainty is a given, having the right insurance is one of the smartest investments a digital nomad can make. It’s not just a safety net—it’s a foundation for sustainable, adventurous living.