When planning travel, one of the important decisions to make is how to approach travel insurance. Two common options often come up: single-trip plans and annual plans. While both serve the fundamental purpose of protecting travelers against unforeseen events, the differences between them can significantly influence their suitability depending on an individual’s travel habits, budget, and risk tolerance. Understanding what sets single-trip and annual plans apart helps travelers make informed choices that balance coverage, convenience, and cost.

A single-trip travel insurance plan is designed to cover one specific journey, typically defined by a set start and end date. This approach appeals to occasional travelers who may take one or two vacations a year or have a single business trip planned. The simplicity of single-trip coverage lies in its focused nature: the policy activates when the traveler departs and terminates upon their return. This clear-cut timeline means that the insurance is tailored specifically to the risks associated with that trip, whether it’s medical emergencies, trip cancellations, or lost luggage. For example, someone flying from New York to Paris for a two-week vacation might opt for a single-trip plan that precisely matches those dates, ensuring they are protected during that window without paying for coverage when they’re at home.

On the other hand, annual travel insurance plans, sometimes called multi-trip plans, provide coverage for multiple trips taken within a twelve-month period. These plans offer a broader safety net for travelers who journey frequently, such as business professionals, consultants, or avid globetrotters. Instead of purchasing separate insurance for each trip, the annual plan simplifies matters by consolidating coverage under one policy that is valid all year round. This not only saves time and administrative hassle but can also be more cost-effective for those who travel regularly. For instance, a sales executive who flies internationally every quarter may find that an annual plan is financially smarter than buying individual single-trip policies for each journey.

One key distinction beyond the duration is how coverage limits and conditions are structured. Single-trip policies often have coverage limits and benefits calibrated for a single journey, reflecting the trip’s length and destination. In contrast, annual plans must balance flexibility with risk management since they cover multiple, sometimes unpredictable, trips. Therefore, annual plans usually impose limits on the maximum duration of any one trip, often capping individual trips at around 30 to 90 days. This means a traveler on an annual plan must be mindful of trip lengths, as extended stays could exceed policy limits and leave gaps in protection. For example, if a family on an annual plan plans a three-month sabbatical abroad, they might need to seek specialized coverage or purchase a single-trip plan to supplement their annual insurance.

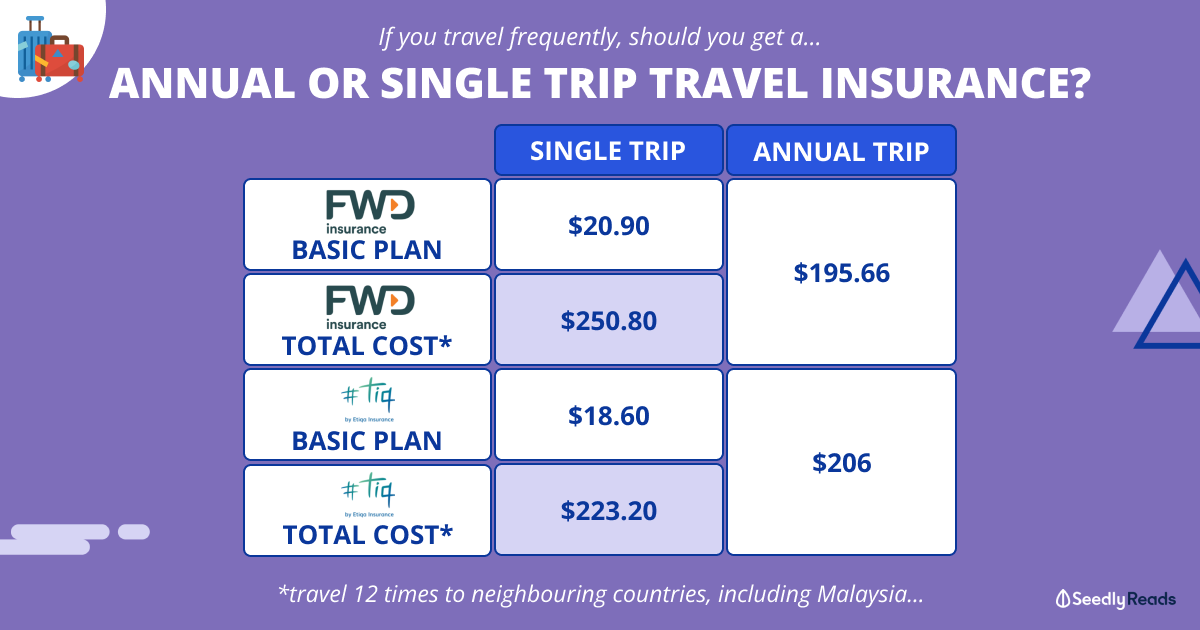

Cost considerations also play a significant role in deciding between single-trip and annual plans. While single-trip policies can be less expensive upfront since they cover a defined period, costs can add up for frequent travelers buying multiple policies. Conversely, annual plans require a higher initial premium but can lead to savings overall if the traveler takes several trips in a year. The economics become clearer when breaking down the cost per trip. Someone taking three or more trips annually often benefits from the predictable expense and streamlined administration of an annual plan. Additionally, some insurers offer tiered annual plans with varying levels of coverage that cater to different travel frequencies and risk profiles, giving consumers flexibility in choosing what fits best.

The convenience factor is another significant difference between the two. Single-trip insurance necessitates purchasing a new policy before each journey, which requires advance planning and comparison shopping to ensure adequate coverage. This can become tedious for frequent travelers who must keep track of renewal dates, varying terms, and insurer reputations for each policy. Annual plans, by contrast, remove much of this friction by providing continuous coverage, enabling travelers to book trips spontaneously without worrying about immediate insurance needs. This ease of use often appeals to busy professionals or families with dynamic schedules where travel plans can change on short notice.

However, neither option is universally better; the choice depends heavily on personal circumstances and travel behavior. A traveler embarking on a once-a-year vacation to a relatively low-risk destination might find a single-trip plan perfectly sufficient. In contrast, a consultant hopping between cities for client meetings throughout the year would likely find an annual plan indispensable for both convenience and cost savings. Moreover, it’s essential to review the policy details carefully, regardless of the type. Factors such as coverage for pre-existing conditions, exclusions for adventure activities, and limits on emergency medical evacuation can vary widely and impact the real value of the plan.

From a business perspective, understanding these differences also matters when companies provide travel insurance to employees. Corporate travel policies might lean toward annual plans to cover multiple business trips efficiently, reducing administrative overhead and ensuring consistent protection. Smaller firms or startups might prefer reimbursing employees for single-trip insurance as needed, depending on budget and travel frequency. Either way, aligning the insurance approach with travel patterns and risk tolerance is crucial to protect both employees and organizational resources effectively.

In conclusion, single-trip and annual travel insurance plans offer distinct advantages tailored to different travel needs. Single-trip policies bring precision and potentially lower upfront costs for infrequent travelers, while annual plans provide flexibility, convenience, and cost efficiency for those on the move regularly. Making the right choice involves assessing how often and how long you travel, your destination risks, and your willingness to manage multiple policies. By carefully weighing these factors, travelers and businesses alike can secure the coverage that best fits their lifestyle and protects against the unpredictable challenges of travel. Ultimately, the right travel insurance plan isn’t just about ticking a box—it’s a strategic decision that supports peace of mind and financial security on every journey.